WEEKLY ECONOMIC ANALYSIS: TECH, AI, QUANTUM, TRUMP POLICIES & CRYPTO

WEEKLY ECONOMIC ANALYSIS: TECH, AI, QUANTUM, TRUMP POLICIES & CRYPTO

1. TECH SECTOR OUTLOOK

Macroeconomic Factors:

The Fed remains cautious; while inflation is slowly easing, rate cuts are expected no earlier than late Q3.

Global chip supply has normalized, boosting U.S. semiconductor and hardware momentum.

Highlights This Week:

NVIDIA may update guidance reflecting continued demand for AI GPU acceleration.

Apple’s WWDC preview will emphasize device-based AI, enhancing competitive positioning in edge computing.

Sentiment: Positive. Capital is flowing into U.S. Big Tech with strong AI positioning.

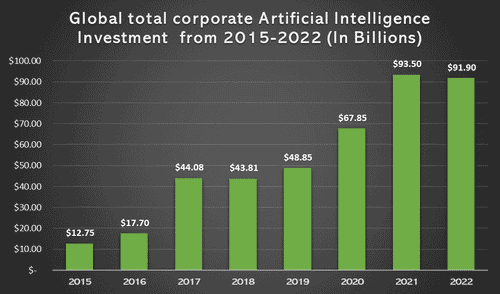

2. ARTIFICIAL INTELLIGENCE INVESTMENTS

Key Drivers:

The AI arms race between OpenAI, Anthropic, Meta, and Mistral continues — with open-weight models and small-LM optimizations taking center stage.

Data center expansion (particularly AI-specific) is accelerating across hyperscalers.

Emerging Trends:

AI for specific verticals (e.g., healthcare, finance) is gaining investor interest.

AI infrastructure (including cooling systems, optical networking) is a growing sub-sector.

Sentiment: Bullish for infrastructure, cautiously optimistic for startups due to valuation premiums.

3. QUANTUM COMPUTING PROSPECTS

Sector Developments:

IBM and IonQ are advancing toward practical error correction at scale.

European and U.S. public funding for quantum systems is accelerating, aimed at achieving early commercial applications.

Investment Notes:

Focus on long-term plays — most companies (like Rigetti and D-Wave) are still pre-revenue or have limited client traction.

Niche firms in quantum cryptography are beginning to show early commercial promise.

Sentiment: Cautiously bullish. Useful for speculative positions or tech ETFs with quantum exposure.

4. CRYPTOCURRENCY MARKETS

Market Overview:

🪙 Bitcoin (BTC) Overview

Price Movement: Bitcoin is trading around $108,909, slightly below its recent all-time high of $111,970 achieved on May 22. The Crypto Times+3Investor's Business Daily+3Decrypt+3

Market Dynamics: The recent surge is attributed to increased institutional interest and favorable regulatory developments. CoinDesk

Institutional Involvement: Cantor Fitzgerald has initiated its Bitcoin lending services, indicating growing institutional adoption. Decrypt

🧠 Ethereum (ETH) Overview

Price Movement: Ethereum is currently priced at approximately $2,641, showing a positive trend with a 3.2% increase.The Crypto Times+2CoinDesk+2Coin Edition+2

Market Dynamics: The upward movement is supported by strong trading volumes and bullish technical indicators, with resistance levels observed around $2,700.

🔮 Market Outlook

Bitcoin: Analysts predict potential growth, with price targets reaching up to $145,000, driven by institutional investments and favorable policies. Investor's Business Daily+1changelly.com+1

Ethereum: Continued bullish momentum is expected, with projections aiming for the $2,800–$3,000 range in the near term. The Crypto Times+1CoinDesk+1

Token Movements:

AI-linked and infrastructure tokens (Chainlink, Filecoin, Render) are getting more attention.

Solana-based memecoins are seeing speculative rallies — watch volume, not just price.

Political Angle:

Trump-allied advisors hint at deregulatory crypto frameworks, in contrast to Biden-era SEC crackdowns.

Sentiment: Bullish on BTC, cautiously optimistic on altcoins with strong utility. Regulatory clarity could spark breakout moves.

SUMMARY OUTLOOK BY SECTOR

Tech: Strong — especially AI hardware, mobile ecosystems, and edge inference.

AI: Growth — infrastructure and enterprise AI continuing expansion.

Quantum: Long-term — speculative positions in cryptography and simulation firms.

Trump Economic Policy: Mixed — volatility around tariffs and reshoring incentives.

Crypto: Rising — BTC and key utility tokens lead; memecoins remain high-risk.